Davizro

Summary

I suggest waiting around for a much less expensive share selling price before acquiring Petco Wellness and Wellness Company (NASDAQ:WOOF).

What I like about WOOF is that it is a enterprise specializing in pet wellness and wellness with a robust presence in the pet care market, which is a massive and desirable industry. Many secular tendencies, which includes the humanization of animals and the reliable progress in the pet inhabitants, are contributing to the expansion of the pet treatment sector in the United States. WOOF is the only vertically integrated, all-encompassing pet treatment supplier in the sector, presenting a large range of quality owned and companion makes as perfectly as expert services these as grooming, training, and veterinary care. This entirely integrated merchandise featuring is supported by WOOF’s powerful digital and actual physical existence, which includes a nationwide network of actual physical destinations and a digital ecosystem with superior abilities.

Firm overview

WOOF is a company that specializes in pet wellness and wellness. Pet health and fitness providers, this sort of as veterinary treatment, grooming, and teaching, are delivered by the company, as are pet nourishment products and supplies.

Pet treatment business is a massive and interesting sector

Many secular trends are contributing to the enlargement of the pet care sector in the United States. With a TAM of more than $100 billion, the pet sector caters to extra than 90.5 million pet-owning properties, or just about 70{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of all US households. Solid tailwinds linked with the humanization of pets, in my opinion, have contributed considerably to the prolonged-term advancement together with the regular, foreseeable enlargement in pet populace. In spite of economic ups and downs, I imagine the pet care sector has confirmed resilient because of to the requirement and consumable character of its products and solutions (equivalent to individuals heading to pharmacies). And inside the overall field, WOOF is producing a concerted effort to raise its profile in the products and services, on-line retail, and veterinary sectors of the industry, as these three represent the swiftest-expanding subsets of the over-all marketplace.

According to the WOOF S-1 filing, pet populace is expected to mature 5{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} traditionally to 7{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} as a result of 2024, which underpins the very long-expression reoccurring will need for pet care items, as we proceed to see constructive shifts in the pet humanization pattern. WOOF is the only vertically integrated, all-encompassing pet care company in the small business, thus I expect it to get a large share of the rising pet treatment current market.

WOOF’s fully integrated product or service presenting

Looking at that no other firm features this kind of a broad wide variety of pet provides and services on a world-wide scale as WOOF does, I assume they have a successful business enterprise product (in accordance to administration in the S-1).

WOOF’s technique to solution enhancement is grounded in the belief that the company can best provide the desires of its numerous shoppers by giving a enormous assortment of quality owned and husband or wife brand names. Together with food stuff, WOOF also shares a substantial selection of pet merchandise to suit needs of concerned pet proprietors. WOOF’s premium product or service providing is, in my view, the result of the firm’s unique meals and materials method, which features proprietary and exceptional brands and would make them accessible to clients in portions that are considerably larger than individuals supplied by rivals (resource: S-1). The actuality that WOOF also provides factors like grooming, coaching, and vet expert services is an additional rationale why I like this tactic. In addition to being a expense-economical way to receive new customers, all of this helps to maintain and increase the life time worth of buyers.

The interconnectedness of WOOF’s multi-channel ecosystem also makes it possible for them to present a whole selection of items and providers via all obtainable channels. The S-1 shows that cross-channel shoppers commit 6 occasions as considerably as single-channel customers, consequently I consider this is a big variable in why individuals use WOOF so frequently.

Sturdy digital and physical existence

Through its years in company, WOOF has recognized a nationwide bodily network and a digital ecosystem with chopping-edge abilities. On the physical entrance, WOOF has the infrastructure to retailer, pack, and ship a vast range of goods and services to shoppers rapidly and very easily. When compared to opponents, I consider that WOOF has a significant advantage due to its proximity to customers on two degrees: (1) a price tag benefit from supply route density, and (2) a reduced charge of transportation (Model consciousness). WOOF has expanded its actual physical presence by setting up itself as the field leader in pet grooming and coaching by way of the use of its substantial physical network. From what I have found, these should-have facilities encourage clients to return to WOOF’s pet care facilities, which ultimately positive aspects the business (clients have a tendency to expend 2x as much with WOOF compared to non-company buyers, in accordance to the S-1). The context of the pet education is well worth mentioning. This assistance is a highly effective buyer acquisition strategy for fostering long-time period loyalty between new pet moms and dads, as instruction is usually completed when the pet is continue to young.

On the electronic front, WOOF tends to make working with Petco.com and the Petco application a fantastic online experience. In my belief, WOOF can supply its users a remarkable omni-channel experience simply because of its strong electronic and actual physical existence. Even far more crucially, I feel that WOOF’s expenditure in establishing its digital portfolio of merchandise and expert services has enormously improved its achieve and development runway. On-line grooming appointment scheduling and cell grooming are just two illustrations of the kinds of minimal-incremental-charge innovations that WOOF can make feasible since of its sturdy electronic capabilities.

When taken as a full, the omni-channel point of view available by this interconnected ecosystem is the driving pressure guiding WOOF’s highly economical advertising and marketing strategy, which in convert boosts shopper life span price and encourages repeat visits.

WOOF’s veterinary hospital is a aggressive advantage

Just like with individuals, the value of veterinary care is an pricey stress. WOOF has remodeled this problem into an prospect by producing a in depth network of veterinary hospitals, clinics, and televeterinary products and services that are uniquely positioned, hugely scalable, and cost-successful. As considerably as I am worried, WOOF has a big structural edge above competing veterinary care providers due to the fact it can give clients with a far more value-productive alternative by incorporating these clinics within current pet care facilities. Possessing a robust world-wide-web existence enables WOOF to provide beneficial products and services, this sort of as on line scheduling.

This strategy tends to make sense, in my opinion, simply because it permits clientele to invest in wellness solutions at the time of check out, when they are by now there. Amazing as it might audio, WOOF has ordinarily necessary about $600,000 in construct-out fees and attained breakeven by the next calendar year.

WOOF need to keep on to reinvest in its digital strategy

In my belief, WOOF would gain from retaining its concentrate on digital internet marketing in mild of the pet industry’s sustained substantial advancement in e-commerce. I be expecting WOOF to substantially develop e-commerce product sales due to the fact of the firm’s commitment to creating its Invest in On line, Pick Up in Retail outlet (BOPUS) and curbside select-up offerings. WOOF’s capacity to integrate its on the web platform with its in-individual providers, this kind of as grooming and schooling, generates a virtuous cycle that will increase the frequency with which its web-site is visited and, by extension, the frequency with which it can cross-offer supplemental items and companies.

I am confident that WOOF, by capitalizing on its technological and operational strengths, will retain its tradition of delivering reducing-edge, novel multi-channel items and companies although also expanding its existence in the e-commerce market.

Valuation

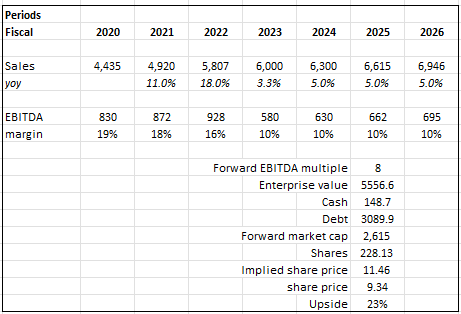

According to my design, buyers can expect a 23{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} return in excess of 3 a long time, which is not the greatest as it indicates ~8{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} IRR.

My design assumptions for WOOF are based mostly on management’s FY23 profits direction and my perception that the company will revert to a extensive-time period mid-single digits development afterwards. Because of to the very levered harmony sheet, I believe that valuing WOOF on an EV/EBITDA basis would be extra ideal as we can comp in opposition to peers.

Very own calculations

Challenges

Competitive landscape

Level of competition in the pet marketplace is higher owing to the prevalence of several various retail formats, such as nationwide chains like Walmart (WMT) and Goal (TGT) as well as area, regional, and on-line marketplaces like PetSmart. Petco’s gross sales and margins may also be threatened by ecommerce and growing competition, specially from on the internet-only competitors like Chewy (CHWY) and BarkBox.

Gross margin may perhaps decrease owing to combine change

As additional product sales are built online and to Veterans, who generally have diminished getting energy, the general gross margin could reduce. Though there will be no improve to fundamental profit in absolute phrases, slipping margins are not a healthier indication.

Leverage

WOOF’s balance sheet is really leveraged (7x internet credit card debt/EBITDA). Although there has been no indication of liquidity difficulties therefore considerably, buyers should be knowledgeable that this could promptly escalate into a important difficulty.

Conclusion

I propose being neutral on WOOF. On the business conclude, what appeals to me about WOOF is that it is a industry leader in the pet treatment market, which is a sizable and promising sector, and that it focuses on pet well being and wellness. The pet treatment field in the United States is growing as a result of a range of secular tendencies. These tendencies include the expanding recognition of possessing pets and the humanization of animals.