The coronavirus pandemic caused major economic and health care disruptions; however, unlike during previous downturns, the coverage expansions put in place by the Affordable Care Act (ACA) served as a safety net for people who lost jobs and access to health coverage. The ACA sought to address the gaps in our health care system that left millions of people without health insurance by extending Medicaid coverage to many low-income individuals and providing subsidies for Marketplace coverage for individuals below 400{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of the federal poverty level (FPL). In addition, policies adopted during the pandemic, including the requirement that states maintain continuous enrollment for Medicaid enrollees and the enhanced subsidies in the Marketplace, protected people against coverage losses and improved the affordability of private coverage, making it easier for low-income individuals most affected by the pandemic to gain and retain coverage. As a result, after increasing for three straight years from 2017 to 2019, the number of nonelderly uninsured individuals dropped by nearly 1.5 million from 28.9 million in 2019 to 27.5 million in 2021, and the uninsured rate decreased from 10.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2019 to 10.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021.

This issue brief describes trends in health coverage during the second year of the pandemic, examines the characteristics of the uninsured population in 2021, and summarizes the access and financial implications of not having coverage. Using data from the American Community Survey (ACS), this analysis compares health coverage data for 2021 to data for 2019; because of disruptions in data collection during the pandemic, the Census Bureau did not release 1-year ACS estimates in 2020.

| How many people are uninsured? With policies in place to protect health coverage for people who may have lost jobs and/or income during the pandemic, the number of uninsured decreased in 2021. In 2021, 27.5 million nonelderly individuals were uninsured, a decrease of nearly 1.5 million from 2019. Coverage gains were driven by increases in Medicaid and non-group coverage that offset declines in employer-sponsored coverage and were particularly large among Hispanic people and people in working families.Who are the uninsured? Most uninsured people are in low-income families and have at least one worker in the family. Reflecting the more limited availability of public coverage in some states, adults are more likely to be uninsured than children. People of color are generally at higher risk of being uninsured than White people, though Asian people have the lowest uninsured rate.Why are people uninsured? Despite policy efforts to improve the affordability of coverage, many uninsured people cite the high cost of insurance as the main reason they lack coverage. In 2021, 64{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of uninsured adults said that they were uninsured because the cost of coverage was too high. Many people do not have access to coverage through a job, and some people, particularly poor adults in states that did not expand Medicaid, remain ineligible for financial assistance for coverage. Additionally, undocumented immigrants are ineligible for Medicaid or Marketplace coverage.How does not having coverage affect health care access? People without insurance coverage have worse access to care than people who are insured. One in five uninsured adults in 2021 went without needed medical care due to cost. Studies repeatedly demonstrate that uninsured people are less likely than those with insurance to receive preventive care and services for major health conditions and chronic diseases.What are the financial implications of being uninsured? The uninsured often face unaffordable medical bills when they do seek care. In 2021, uninsured nonelderly adults were over twice as likely as those with private coverage to have had problems paying medical bills in the past 12 months. These bills can quickly translate into medical debt since most people who are uninsured have low or moderate incomes and have little, if any, savings. |

How many people are uninsured?

After several years of coverage losses prior to the start of the pandemic, the uninsured rate dropped from 2019 to 2021, driven largely by increases in Medicaid coverage as well as increases in non-group Marketplace coverage during the pandemic. Coverage gains were larger among nonelderly Hispanic and Asian people compared to their White counterparts and among low-income individuals and those in working families versus those at higher incomes and those without a worker in the family.

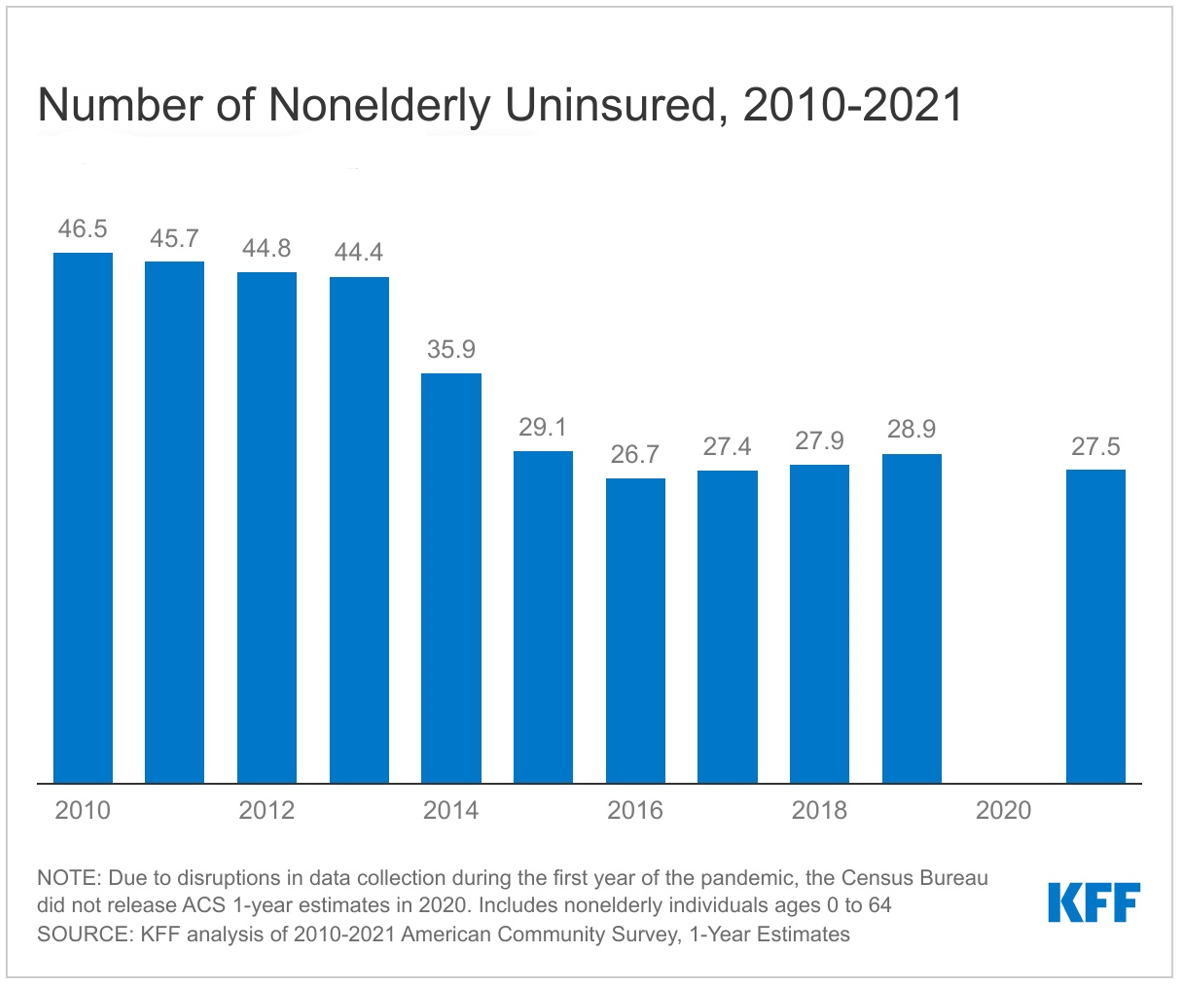

The number of uninsured individuals remains well below levels prior to enactment of the ACA. The number of uninsured nonelderly individuals dropped from more than 46.5 million in 2010 to fewer than 26.7 million in 2016, climbed to 28.9 million individuals in 2019 before dropping again to 27.5 million in 2021. We focus on coverage among nonelderly people since Medicare offers near universal coverage for the elderly, with just 441,000, or less than 1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}, of people over age 65 uninsured.

Key Details:

- The uninsured rate dropped in 2021, reversing an upward climb from 2017 to 2019. The uninsured rate in 2021 declined to 10.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} from 10.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2019, and the number of people who were uninsured in 2021 decreased by 1.5 million from 2019 to 2021 (Figure 1).

- In 2021, the drop in the number of people without health insurance was driven primarily by an increase in Medicaid coverage as well as a smaller increase in non-group coverage, which includes coverage in the Marketplaces. These coverage gains reflect federal policies designed to stabilize coverage, particularly Medicaid coverage, during the pandemic. Provisions in the Families First Coronavirus Response Act (FFCRA) prohibit states from disenrolling people from Medicaid until the month after the COVID-19 public health emergency (PHE) ends in exchange for enhanced federal funding. In addition, the American Rescue Plan Act (ARPA) provided enhanced ACA Marketplace subsidies that were renewed for another three years in the Inflation Reduction Act of 2022 (IRA). As a result, the share of people covered by Medicaid increased by 1.5 percentage points, from 21.0{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2019 to 22.5{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021 and the share of people with non-group coverage increased from 6.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2019 to 7.3{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021. At the same time, likely due to pandemic-related disruptions to employment, the share of people with employer-sponsored insurance dropped from 58.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2019 to 57.0{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021 (Figure 2).

- Administrative data point to larger gains in Medicaid coverage than are estimated by the ACS. According to data from the Centers for Medicare and Medicaid Services (CMS), Medicaid enrollment in December 2021 had increased by nearly 22{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} since February 2020, with 87 million enrolled compared to 68 million with Medicaid coverage in 2021 reported by the ACS. Some of the discrepancy can be explained by different ways of counting people, but some people may misreport their source of coverage on the survey because they do not know they are covered by Medicaid. In addition, national survey data typically undercount lower income people who are more likely to be covered by Medicaid. While these discrepancies are longstanding, they appear to have doubled during the pandemic.

- Hispanic people experienced the largest drop in their uninsured rate in 2021, falling from 20.0{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2019 to 19.0{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021 (Figure 3). Uninsured rates also decreased for Asian people (from 7.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} to 6.4{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}), White people (from 7.8{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} to 7.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) and Black people (from 11.4{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} to 10.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}). The uninsured rates for American Indian and Alaska Native (AIAN) and Native Hawaiian and Other Pacific Islander (NHOPI) people were not significantly different from 2019 in 2021.

- Coverage gains were greater for nonelderly adults compared to children. The uninsured rate for nonelderly adults fell nearly 0.8 percentage points from 12.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2019 to 12.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021 while the uninsured rate for children dropped a more modest 0.3 percentage points from 5.6{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} to 5.3{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} (Figure 3). While increases in Medicaid coverage rates were similar for nonelderly adults and children, the decline in employer-sponsored coverage was larger for children, reducing overall coverage gains.

- Individuals in low-income families experienced the largest uninsured rate declines. For those with income below 200{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} FPL, the uninsured rate dropped from 18.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2019 to 17.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021 while the uninsured rate declined from 7.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} to 7.5{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} for those with incomes greater than 200{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} FPL (Figure 3). There was no significant decline in the uninsured rate for individuals with income above 400{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} FPL.

- Changes in the number of uninsured individuals varied across states in 2021. A total of 22 states experienced decreases in the number of nonelderly uninsured individuals, including 17 Medicaid expansion states and 5 non-expansion states. However, the uninsured rate for the group of expansion states was nearly half that of non-expansion states (7.7{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} vs. 15.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}). No state experienced a statistically significant increase in the number of uninsured in 2021 (Appendix Table A).

Who are the uninsured?

Most of the 27.5 million people who are uninsured are nonelderly adults, in working families, in families with low incomes and six in ten are people of color. Reflecting geographic variation in income and the availability of public coverage, most uninsured people live in the South or West. In addition, most who are uninsured have been without coverage for long periods of time. (See Appendix Table B for detailed data on characteristics of the uninsured population.)

Key Details:

- Of the total nonelderly uninsured population in 2021, just over seven in ten (70.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) had at least one full-time worker in their family and an additional 11.6{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} had a part-time worker in their family. More than eight in ten (81.6{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) uninsured people were in families with incomes below 400{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} FPL in 2021 and nearly half (48.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) had incomes below 200{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} FPL. In addition, people of color made up 45.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of the nonelderly U.S. population but accounted for 61.3{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of the total nonelderly uninsured population. Hispanic and White people comprised the largest shares of the nonelderly uninsured population at 39.0{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} and 38.7{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}, respectively (Figure 4). Most of the uninsured (77.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) were U.S. citizens while 22.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} were non-citizens in 2021 and nearly three-quarters live in the South and West.

- Nonelderly adults are more likely to be uninsured than children. The uninsured rate among children was 5.3{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021, less than half the rate among nonelderly adults (12.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}), largely due to broader availability of Medicaid and CHIP coverage for children than for adults (Figure 5).

- In general, people of color are at higher risk of being uninsured than White people. The uninsured rates for Hispanic people (19.0{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) and American Indians and Alaska Natives (21.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) are more than 2.5 times the uninsured rates for White people (7.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) (Figure 5). However, like in previous years, Asian people have the lowest uninsured rate at 6.4{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}.

- Non-citizens are more likely than citizens to be uninsured. The uninsured rate for recent immigrants, those who have been in the U.S. for less than five years, was 28.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} in 2021, while the uninsured rate for immigrants who have lived in the US for more than five years was 34.8{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}. By comparison, the uninsured rate for native citizens was 8.4{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} and 10.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} for naturalized citizens in 2021 (Appendix Table B).

- Uninsured rates vary by state and by region; individuals living in non-expansion states are more likely to be uninsured (Figure 5). Ten of the fifteen states with the highest uninsured rates in 2021 were non-expansion states as of that year (Figure 6 and Appendix Table A). Economic conditions, availability of employer-sponsored coverage, and demographics are other factors contributing to variation in uninsured rates across states.

- Over two-thirds (73.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) of the nonelderly adults uninsured in 2021 have been without coverage for more than a year. People who have been without coverage for long periods may be particularly hard to reach in outreach and enrollment efforts.

Why are people uninsured?

Most of the nonelderly in the U.S. obtain health insurance through an employer, but not all workers are offered employer-sponsored coverage or, if offered, can afford their share of the premiums. Medicaid covers many low-income individuals; however, Medicaid eligibility for adults remains limited in some states that have not adopted the ACA expansion. With the Medicaid continuous enrollment requirement in place during the PHE, Medicaid coverage increased in many states. While financial assistance for Marketplace coverage is available for many moderate-income people, few people can afford to purchase private coverage without financial assistance.

Key Details:

- Cost still poses a major barrier to coverage for the uninsured. In 2021, 69.6{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of uninsured nonelderly adults said they were uninsured because coverage is not affordable, making it the most common reason cited for being uninsured (Figure 7). Other reasons included not being eligible for coverage (26.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}), not needing or wanting coverage (23.5{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}), and signing up being too difficult (19.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}).

- Not all workers have access to coverage through their job. In 2021, 64.4{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of nonelderly uninsured workers worked for an employer that did not offer them health benefits. Among uninsured workers who are offered coverage by their employers, cost is often a barrier to taking up the offer. From 2012 to 2022, total premiums for family coverage increased by 43{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}, and the worker’s share increased by 41{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}, outpacing wage growth. Low-income families with employer-based coverage spend a significantly higher share of their income toward premiums and out-of-pocket medical expenses compared to those with income above 200{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} FPL.

- Medicaid eligibility varies across states and eligibility for adults is limited in states that have not expanded Medicaid. As of November 2022, 40 states including DC had adopted the ACA Medicaid expansion, although only 39 states had implemented the expansion in 2021. In states that have not expanded Medicaid, the median eligibility level for parents is just 39{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} FPL and adults without dependent children are ineligible in most cases. Additionally, in non-expansion states, millions of poor uninsured adults fall into a “coverage gap” because they earn too much to qualify for Medicaid but not enough to qualify for Marketplace premium tax credits.

- Many lawfully present immigrants must meet a five-year waiting period after receiving qualified immigration status before they can qualify for Medicaid. Among those immigrants who are eligible for Medicaid, concerns over Trump-era changes to the federal public charge immigration policy may cause some to not enroll. Although the Biden Administration reversed the changes, fear and confusion may persist. Lawfully present immigrants are eligible for Marketplace tax credits, including those who are not eligible for Medicaid because they have not met the five-year waiting period. However, undocumented immigrants are ineligible for Medicaid or Marketplace coverage.

- Though financial assistance is available to many of the remaining uninsured under the ACA, not everyone who is uninsured is eligible for free or subsidized coverage. Many people who were uninsured were eligible for financial assistance either through Medicaid or through subsidized Marketplace coverage. However, that leaves many people outside the reach of the ACA because their state did not expand Medicaid, their immigration status made them ineligible, or they were deemed to have access to an affordable Marketplace plan or offer of employer coverage. Some uninsured who are eligible for help may not be aware of coverage options or may face barriers to enrollment, and even with enhanced subsidies, Marketplace coverage may be unaffordable for some uninsured individuals.

How does not having coverage affect health care access?

Health insurance makes a difference in whether and when people get necessary medical care, where they get their care, and ultimately, how healthy they are. While the COVID-19 pandemic affected health care utilization broadly, uninsured adults are far more likely than those with insurance to postpone health care or forgo it altogether because of concerns over costs. The consequences can be severe, particularly when preventable conditions or chronic diseases go undetected.

Key Details:

- Studies repeatedly demonstrate that uninsured individuals are less likely than those with insurance to receive preventive care and services for major health conditions and chronic diseases.,,, Although, overall, people reported lower utilization of health care services during the pandemic and fewer barriers due to cost, disparities between those who lack health coverage and those with coverage persisted. In 2021, nearly half (46.7{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) of nonelderly uninsured adults reported not seeing a doctor or health care professional in the past 12 months compared to 18.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} with private insurance and 13.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} with public coverage. Just over one in five (20.7{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) nonelderly adults without coverage said that they went without needed care in the past year because of cost compared to 5.0{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of adults with private coverage and 6.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of adults with public coverage. Part of the reason for poor access among the uninsured is that many (40.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) do not have a regular place to go when they are sick or need medical advice (Figure 8).

- Many uninsured people do not obtain the treatments their health care providers recommend for them because of the cost of care. In 2021, uninsured nonelderly adults were 2.5 times as likely as adults with private coverage to say that they delayed filling or did not get a needed prescription drug due to cost (12.4{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} vs. 4.7{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}). And while insured and uninsured people who are injured or newly diagnosed with a chronic condition receive similar plans for follow-up care, people without health coverage are less likely than those with coverage to obtain all the recommended services.,

- Uninsured children were more likely than those with private insurance to go without needed care due to cost in 2021 (6.6{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} versus less than 1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}). Furthermore, nearly one-third (32.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) of uninsured children had not seen a doctor in the past year compared to 8.1{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} and 8.0{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} for children with public and private coverage, respectively (Figure 9).

- Because people without health coverage are less likely than those with insurance to have regular outpatient care, they are more likely to be hospitalized for avoidable health problems and to experience declines in their overall health. When they are hospitalized, uninsured people receive fewer diagnostic and therapeutic services and also have higher mortality rates than those with insurance.,,,,

- Research demonstrates that gaining health insurance improves access to health care considerably and diminishes the adverse effects of having been uninsured. A review of research on the effects of the ACA Medicaid expansion finds that expansion led to positive effects on access to care, utilization of services, the affordability of care, and financial security among the low-income population. Medicaid expansion is associated with increased early-stage diagnosis rates for cancer, lower rates of cardiovascular mortality, and increased odds of tobacco cessation.,,

- Public hospitals, community clinics and health centers, and local providers that serve underserved communities provide a crucial health care safety net for uninsured people. However, safety net providers have limited resources and service capacity, and not all uninsured people have geographic access to a safety net provider.,, High uninsured rates also contribute to rural hospital closures, leaving individuals living in rural areas at an even greater disadvantage to accessing care.

What are the financial implications of being uninsured?

Uninsured individuals often face unaffordable medical bills when they do seek care. These bills can quickly translate into medical debt since most of the uninsured have low or moderate incomes and have little, if any, savings.,

Key Details:

- Those without insurance for an entire calendar year pay for over 40{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of their care out-of-pocket. In addition, hospitals frequently charge uninsured patients much higher rates than those paid by private health insurers and public programs.,,

- Uninsured nonelderly adults are much more likely than their insured counterparts to lack confidence in their ability to afford usual medical costs and major medical expenses or emergencies. More than three quarters (75.2{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}) of uninsured nonelderly adults say they are very or somewhat worried about paying medical bills if they get sick or have an accident, compared to 45.9{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of adults with Medicaid/other public insurance and 44.3{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} of privately insured adults (Figure 10).

- Medical bills can put great strain on the uninsured and threaten their financial well-being. In 2021, nonelderly uninsured adults were more than twice as likely as those with private insurance to have problems paying medical bills (20.3{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc} vs. 8.7{35112b74ca1a6bc4decb6697edde3f9edcc1b44915f2ccb9995df8df6b4364bc}; Figure 10). Uninsured adults are also more likely to face negative consequences due to medical bills, such as using up savings, having difficulty paying for necessities, borrowing money, or having medical bills sent to collections resulting in medical debt.

- While federal law requires nonprofit hospitals to provide some level of charity care as a condition of receiving tax-exempt status, and many state governments impose additional requirements on hospitals to extend eligibility for charity care, not all eligible patients benefit from these programs because they do not know about the programs, do not know how to apply, have their application improperly denied, or choose not to apply. Consequently, charity care costs represents a small share of operating expenses at many hospitals. State, federal, and private funds defray some but not all hospital charity care and bad debt costs. With the expansion of coverage under the ACA, providers have seen reductions in uncompensated care costs, particularly in states that expanded Medicaid.

- Research suggests that gaining health coverage improves the affordability of care and financial security among the low-income population. Multiple studies of the ACA have found larger declines in trouble paying medical bills in expansion states relative to non-expansion states. A separate study found that, among those residing in areas with high shares of low-income, uninsured individuals, Medicaid expansion significantly reduced the number of unpaid bills and the amount of debt sent to third-party collection agencies.

Conclusion

Largely due to policies put in place during the COVID-19 pandemic to stabilize coverage, the number of people without health insurance dropped in 2021. The coverage gains were driven primarily by increases in Medicaid coverage due to the continuous enrollment requirement that has been in effect since the start of the pandemic. The increases in Medicaid as well as smaller gains in nongroup coverage offset declines in employer coverage, leading to the drop in the number of uninsured and the uninsured rate. While the improvements in coverage were widespread, they were particularly large for Hispanic people, those in low-income families, and among people in working families, including those with only part-time workers in the family.

The end of the COVID-19 PHE could reverse these recent coverage gains. Once the PHE ends, which is expected sometime next year, states will resume Medicaid redeterminations and will disenroll people who are no longer eligible or who are unable to complete the renewal process even if they remain eligible. As a result, KFF estimates that between 5 and 14 million people could lose Medicaid coverage, including many who newly gained coverage during the pandemic. Recent funding increases for Navigators and other efforts to increase outreach and the availability of enrollment assistance can help people complete the Medicaid renewal process, and if found no longer eligible, transition to other coverage. The continued availability of the enhanced Marketplace subsidies will make that coverage more affordable for people who are disenrolled from Medicaid and may increase the share of people who successfully transition from Medicaid to Marketplace coverage. Still, any large increase in the number of people who are uninsured could undermine improvements in access to care and financial stability that come with having health coverage and could worsen disparities in health outcomes.